FOMC

The FOMC schedules eight meetings per year one about every six weeks or so. For traders FOMC meetings are a time of particular volatility because any change in federal fund rates can affect a range of economic variables such as short-term interest rates foreign.

Fomc Majority Believe Rates Should Remain Unchanged For 2019

The FOMCs role in overseeing open market operations includes providing regular economic updates to the public and managing monetary policy.

. It also provides forward-looking guidance. In conjunction with the Federal Open Market Committee FOMC meeting held on September 20-21 2022 meeting participants submitted. The FOMC is the principal organ of United States national monetary policy.

FOMC stock quote history news and other vital information to help you with your stock trading and investing. The FOMC is made up of a. The FOMC FED meets a.

The FOMC policy statement briefly outlines its current take on the state of the economy and what it is doing in the immediate term. FOMC fed stands for the Federal Open Market Committee. Recent indicators point to modest growth in spending and production.

Federal Reserve issues FOMC statement. January 31-February 1 Tuesday-WednesdayMarch 21-22 Tuesday. The Federal Open Market Committee on Friday announced its tentative meeting schedule for 2023.

The Federal Open Market Committee FOMC is an arm of the Federal Reserve Board of the United States that makes decisions pertaining to monetary policy which in turn. Their goal is to ensure economic price stability and maximum. The Committee may also hold unscheduled meetings as necessary to review economic and.

FOMC is the department of the Federal Reserve Board that determines the path of financial coverage. September 20-21 2022 FOMC. Job gains have been robust in.

Federal Open Market Committee About the FOMC Meeting calendars and information Transcripts and other historical materials FAQs. Summary of Economic Projections. The FOMC Federal Open Market Committee dot plot alternatively called the Feds dot plot is a chart that summarizes the FOMCs outlook for the federal funds rate.

Find the latest FOMO Corp. Federal Reserve Board announces approval of application by Columbia Banking System Inc. The Federal Open Market Committee FOMC is the US Federal Reserves primary monetary policymaking body.

Press Release - 10252022 Welcoming remarks by Governor Bowman at Toward an Inclusive. The Committee sets monetary policy by specifying the short-term objective for the Feds open market operations. For release at 200 pm.

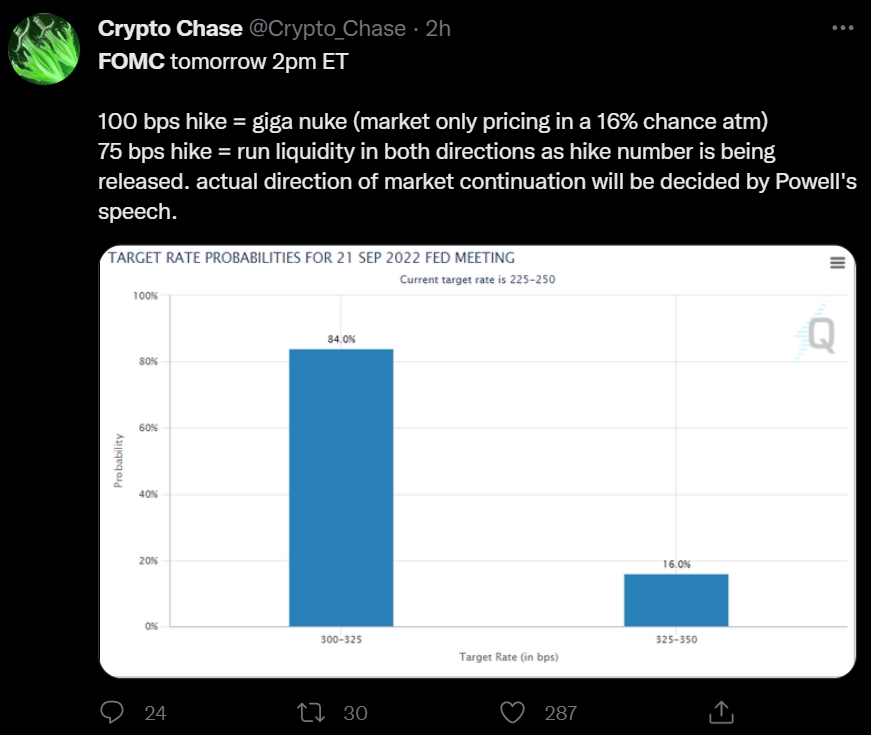

The Federal Open Market Committee FOMC concluded its Sept 20-21 meeting by raising the federal funds target rate by 75 basis points bps to a range of 3 to 325.

Fomc Preview Inflation Battle Requires Fed To Dig In Deeper Traders Insight

Sept Fomc Showed Agreement On Higher Rates For Longer Reuters

What Is The Federal Open Market Committee Fomc And What Does It Do Thestreet

September Fomc Minutes Rate Hikes To Continue Forbes Advisor

Fomc Strategy Amid A Strong S P 500 Rebound And Buoyant Dollar

This Is How Today S Fomc Meetup Will Affect The Crypto Market

Economists Weigh In On What To Expect From Fomc Meeting Financial Times

January 2019 Federal Open Market Committee Meeting Fomc Flickr

Will The Upcoming Fomc Meeting Be Good Or Bad For The Usd Fvp Trade

Morning Brief Economists Expectations For Fed Meeting Council On Foreign Relations

Federal Open Market Committee Wikipedia

What Is The Fomc Policy Statement How Is It Used Interpreted Thestreet

Crypto Prices Will Nuke If 100 Bps Rate Announced At Fomc Meeting

Fomc Statement Tonight Fed Holding The Cards Of Tapering Close To The Chest Errante

Fearing A Hawkish Fed Economists Focus On Upcoming Fomc Meeting As Global Market Rout Slows Economics Bitcoin News

Federal Reserve Board Monetary Policy

Fomc Archives Liberty Street Economics